10 things to consider when buying a car insurance

Owning and driving a car is a pleasurable experience. Cars are expensive and as an owner, you would certainly want to avoid accidents to mitigate the cost of repair. Third-party insurance is mandatory in Malaysia, where you pay an annual premium to cover the repair costs to a great extent. With several banks and financial institutions offering car insurance, you must be wondering which one will be best for you.

Before you hit the road with your brand new vehicle, here are 10 things to consider when buying car insurance.

- Coverage

While buying a minimum coverage will save you some money, it may not be the best option. Consider all possible coverage like collision, uninsured and underinsured motorist protection, personal injury, and comprehensive protection. A comprehensive plan includes non-crash incidents like theft, fire and natural disasters, while collision coverage comprises all repairs, irrespective of whose fault it is.

- Brand

The brand of the insurance company is among the things to consider when buying car insurance. Rely on a well known, established brand than a company which you haven’t heard of. The moment of truth for the customer comes at the time of settling claims. Not all companies command the same reputation. Go for a trusted brand.

- Customer care support

Is the insurance company open 24x7? Will they provide the fastest coverage? Seeing your car breaking down in the middle of nowhere and getting no reply from the insurance company will multiply your misery. However, in an increasingly competitive market, most companies are offering a 24x7 service, lest they lose customers. Check if the insurance provider has a countrywide toll-free number.

- Payment options

Automobile insurance premium can be paid monthly or annually. The latter has to be paid in a lump sum but comes with a discount. Choose a plan according to your current financial situation and your budget.

- Networked garages

Insurance providers have a network of garages where the repairing and servicing of the vehicle is carried out. Look for an insurer who has the maximum number of networked garages where you can avail cashless settlement of your claims. That aside, in a networked garage, the service is easier and faster involving fewer hassles.

- Check the claim data

The claim data is a record of the claims settlement process by the insurer. New insurers typically have a low claim settlement ratio. The ratios of claim settlement and incurred claim can be checked to determine the reliability of the insurance company. Genuine claims are rarely rejected by an insurer. However, being informed about the insurer’s efficiency will help in understanding its reliability. Choose a company which has the best claim settlement ratio and an easy process.

- Accumulate the no-claims bonus

Accumulating the no-claims bonus (NCB) is a great way of reducing your car insurance premium. A percentage of the accumulated NCB can be used later. The NCB is linked to the holder of the car insurance policy and not the car insured. You can benefit from the accumulated NCB at the time of replacing your old car or if you switch from one insurer to another while renewing the policy.

- Zero depreciation cover

The zero depreciation cover comes with an additional cost to the premium. This means, whenever you raise a claim, everything will be completely reimbursed including the parts required to be replaced. The insurer won’t deduct anything for depreciation. While such a scheme commands a higher premium, it ensures peace of mind in case there’s an accident.

- Consider buying online

The biggest advantage of buying car insurance online is that it saves you both time and money. Also, you have a greater choice in selecting the insurance policy since all the insurers are available in one place. Taking an informed decision about which insurance to buy is also easier online since you can research various companies.

- Ask questions

Before buying car insurance, you have to consider several points that include risk assessment, policy coverage, what will be the deductible amount, and the fair value of the vehicle. There are a number of cancellation rules as well. Each car insurance policy comes with its own set of rules. Feel free to ask questions, especially about the terms and clauses that may be unknown to you.

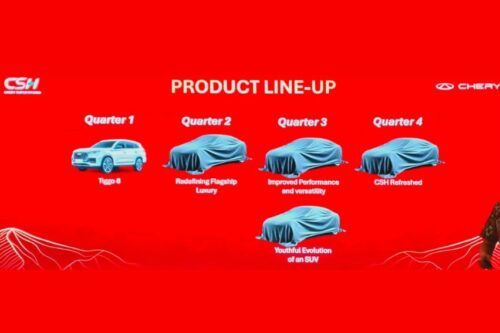

Malaysia Autoshow

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

Featured Cars

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels