Malaysia Automarket Drops in the First Half of 2015

Kuala Lumpur: Malaysian Automotive Market fell down in the first half of this year after the GST implementation on 1st April. According to a report, Perodua and Proton held the maximum market share of 50% and the best-selling model so far in this half is Proton Saga followed by Perodua Myvi and Perodua Alza.

In the first quarter of this year, Malaysian markets faced a strong growth despite the increasing fuel prices and external demands. However, after the implementation of Goods and Services Tax in April 2015, the market faced a serious plunge which affected all the domestic and International sellers. This GST also resulted in suppressed demands of imports affecting the external contribution of Automakers into the Malaysian market. Another factor that adversely affected the sales figures was the plummeting ringgits, as the Malaysian currency faced its nine-year low against the dollar on June 8, measuring only 3.75 RM per USD. This currency depreciation resulted in a price rise of common consumer goods limiting the potential car buyers.

Read Also: Malaysia: The Curious Case of Sales Drop – A 2015 Classic

From past five years Malaysian auto market is moving on a medium growth pattern with average sales of 0.6 Million vehicles in four years, except the year 2014 with an all-time record sale. Future perspectives of 2015 are uncertain as the government is planning to introduce an all new tax on goods and service which is anticipated to hit all the consumer goods market. It can be speculated because the positive first quarter faced a huge decline after implementation of GST causing a market fall of 9.6% in May and -1.4% in June.

Read Also: MAA - Sales figure rises in July 2015, still lower than 2014

Coming to the sales number, according to a data report released by the Malaysian Automotive Association (M.A.A), new light passenger vehicles sold in the first half of 2015 were 327.778 facing a 1.3% decline compared to the preceded year.

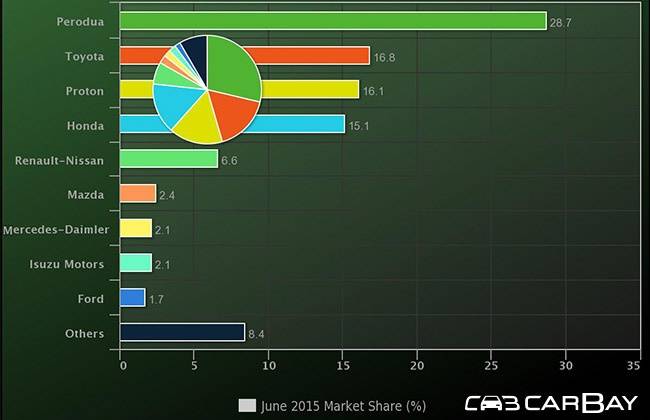

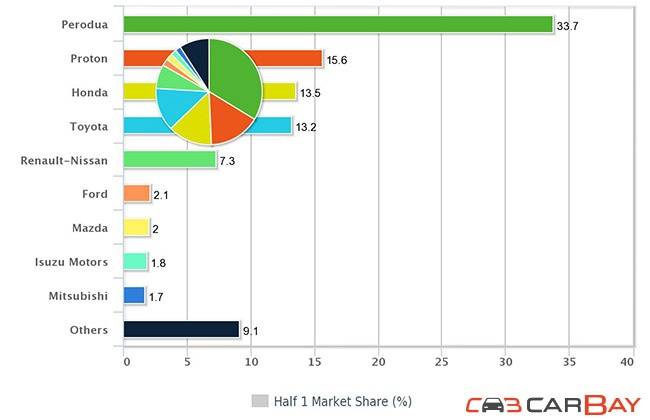

The local makers Proton and Perodua rules 50% of the automotive market in Malaysia, leaving behind the Japanese makers Toyota, Honda and Nissan. Perodua is on the top with enchanting sales figures of 16.475 vehicles in June having a mega share of 28.7%, which is still 2.0 points down to its previous month performance. Following the Perodua is Proton with sales numbers of 9.267 vehicles (-6.8%) in June having a market share of 15.6% with cumulative sales of 50.206 (-20.4%). The third position is acquired by Toyota selling 8.979 units (-7.3%) having 15.6% market share followed by Honda with 8.688(+19.8%) and Nissan with 3,765 (+24.7%).

Read Also: Proton and Perodua – Kings of the Pond, Fishes of the Sea

Ranking stats can be clearly seen in the table below showing Perodua as the market leader with 28.7% market share leaving behind Toyota at 16.8% and Honda at 15%. The best selling car in the first half of 2015 comes out to be Proton Saga with sales figures of 50.382 units. Proton Saga has proved to be the people's car and is followed by another acclaimed vehicle Perodua Myvi with sales figures of 26.611 units closely followed by Perodua Alza with 25.386 units.

June 2015 Market Share(%)

First Half Market Share(%)

Malaysia Autoshow

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

Featured Cars

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels